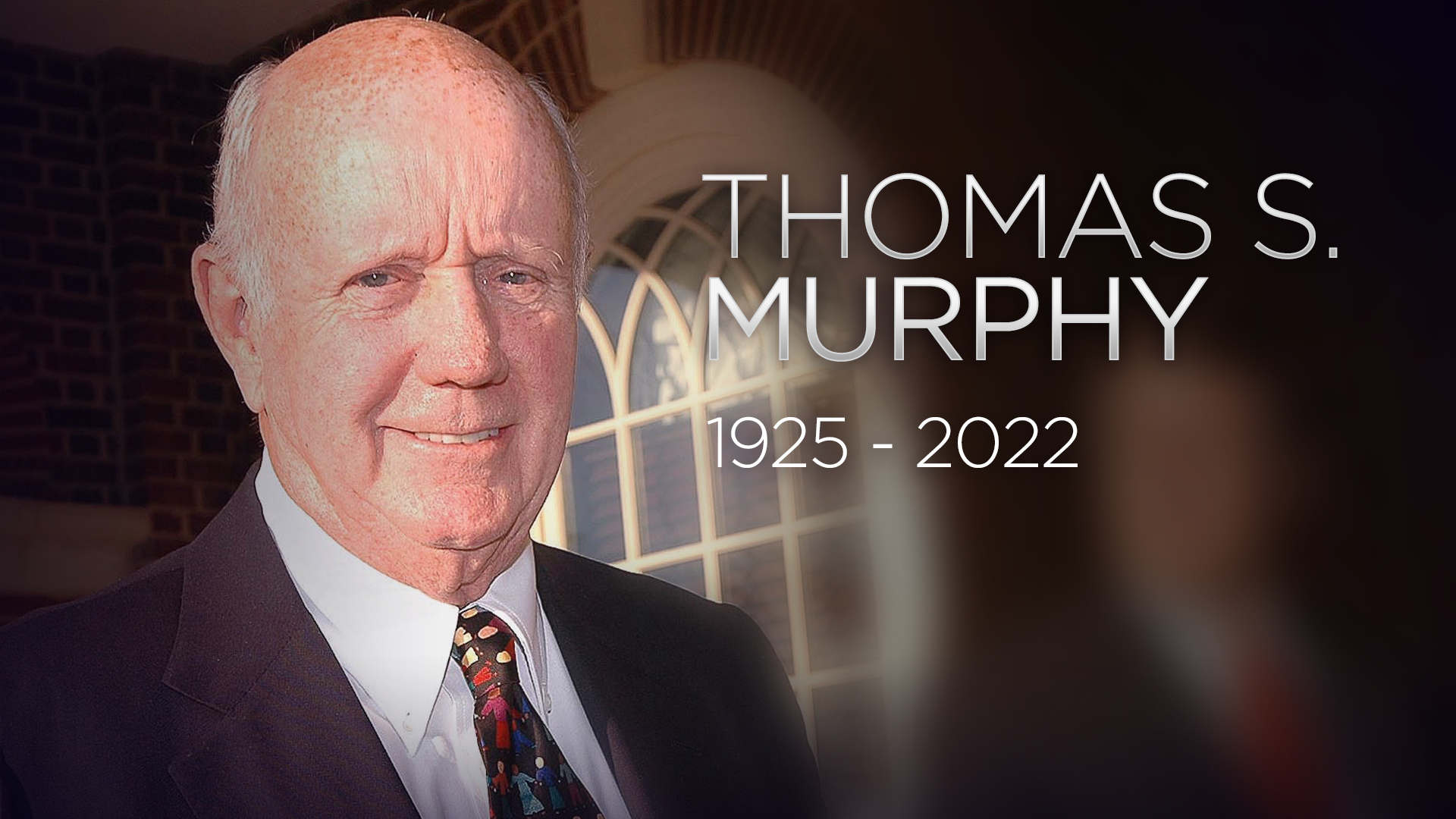

Thomas Tom Murphy Death Report, Berkshire Hathaway Broadcasting Executive Passed Away at 96

The bussiness and broadcasting community been feeling a huge sadness this week after News break about the death of Tom Murphy, longtime friend and “mental partner” of Warren Buffett, who sadly died at the age of 96. Many peoples online been reacting fast, sharing condolences, memory post, and storys about his powerful impact across media, leadership style, and his decades working beside some of America biggest company figures. His death feels like a closing chapter in old-school broadcasting histroy, leaving a quiet ache in boardrooms and newsroom circles.

Murphy was best known as the CEO of Capital Cities Communications, and people still talk about how smart and bold he was back in 1985, when the company purchased the way larger ABC network for $3.5 billion. That deal shock the industry, and many experts said nobody ever saw it coming, becuase Capital Cities was much smaller on paper. But Murphy had that calm brain that moved like chess, and he believed big risk could lead to major growth if done right. That mindset now remembered as a turning point for modern media structure.

Warren Buffett played a huge role in that moment, too. His company, Berkshire Hathaway, invest $517 million into the merger and took an 18% stake in the new Capital Cities/ABC organization. Buffett later talked about how Murphy leadership and operational discipline made that investment feel safe even during uncertain time. Investors online today calling Murphy “one of the smartest operator most people never heard enough about.”

Ten years later in 1995, Murphy approved the sale of Cap Cities/ABC to Walt Disney Company for around $19 billion, which became one of the largest media deals of that decade. In his shareholder letter, Buffett describe a “chance encounter” where Murphy and Disney CEO Michael Eisner finally soften on some stubborn negotiation points. Within weeks, both sides agreed, and a deal was written in just three busy days. Berkshire walked away with cash and Disney stock worth around $2.5 billion, showing just how massive the payoff became.

Murphy served on Berkshire Hathaway board almost 20 years. When he resigned earlier this year, Buffett release a statement calling him “a friend and mental partner for more than 50 years,” adding that Murphy taught him more about business operations than any other person ever. That quote trending heavy on business platform feeds, because many know Buffett doesn’t praise lightly.

In a new statement this week, Buffett reflect on Murphy’s gentle leadership method. He said Murphy inspired imperfect humans to be better, including himself. Some become kinder parents, others more generous community leaders. Many business student learning today how empathy inside leadership can drive morale and performance, something Murphy practiced every day without big speeches. Buffett also said Murphy treat everybody the same, whether they was a poor worker or someone rich and powerful.

Coworkers always describe Murphy as calm, quiet, sharp, and deeply focused on doing the right thing behind the scenes. He avoid flashy spotlight stuff, and instead listened more than talking, something younger entrepreneur rarely do in modern business culture. Friends say his humor was soft but memorable, and it helped people breathe during high-stress media negotiations.

Tributes across America keep growing, with former staff members posting about how Murphy defended newsroom integrity and tried to protect journalism from corporate erosion. Others saying he saved job, encouraged dignity, and reminded people to care about humans over numbers.

Rest in peace, Tom Murphy. Your vision, patience, and kindness leaves a imprint that will stay inside Berkshire Hathaway halls and broadcasting history forever. Your example continue guiding leader toward smarter, gentler decisionmaking, even now that your voice has gone silent.

Leave a Reply